U.S (Transatlantic Today) – The pandemic affected the entire world; and it seems pretty safe to say that the world is still reeling. It’s difficult to predict the effects that the pandemic — and everything that came with it — has had on the economy. But despite the relatively short gap between the last recession and now, some experts believe that the United States is entering a new recession.

There are several reasons as to why experts are saying this. Firstly, certain experts believe that the United States’ economic statistics are all but completely artificial. Experts say that America’s Gross Domestic Product (GDP) is artificially high, asserting that the accurate GDP lags one year behind what the current data reveals. The unemployment rate is artificially low. In fact, experts believe that never-before-seen support from the government — in the form of unemployment insurance and various other economic stimulus — belies the truth.

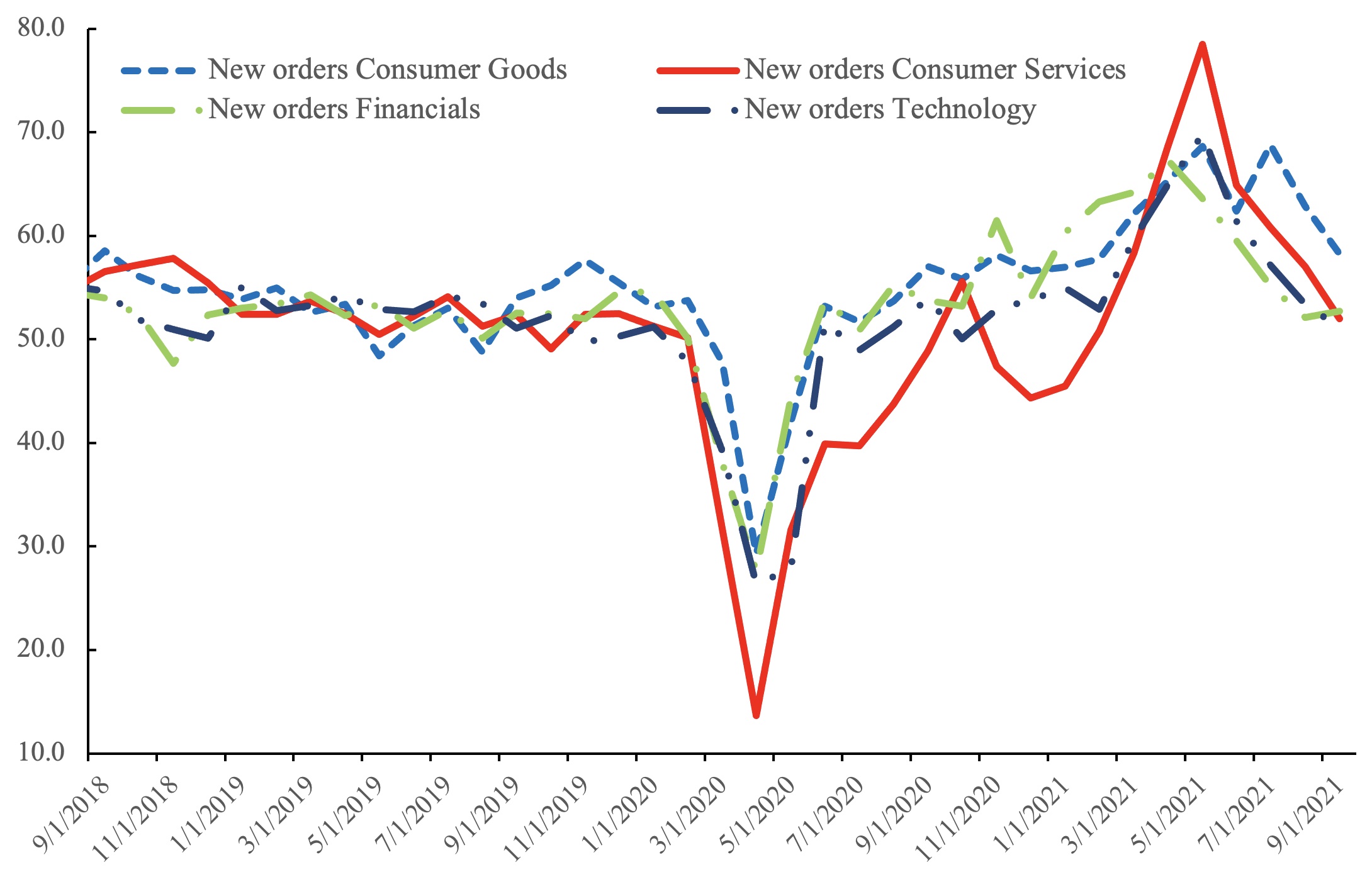

Finally, the consumer data numbers are troubling. Consumer confidence indices ask everyday Americans about their views on the economy, including their opinions on the future of employment and income. Data shows that every recession since the 1980s has been preceded by a 10-point decrease in consumer confidence indices from major sources. This year, those same sources have seen, on average, over a 20-point decrease. Such results do not bode well for the future of the American economy.

Other experts still see COVID as a huge determining factor when it comes to the economy. No one can deny that COVID shocked the public, as well as the economic situation, and some experts believe that the effects of COVID have the potential to cause continuing negative economic effects. In fact, some experts believe that lingering fears about COVID will continue to affect both the economy and consumer expectations about the state of the environment. For example, many people (42%) are worried about returning to work for fear of contracting COVID.

But that’s not all. COVID has caused ripple effects throughout numerous industries. Food and gas prices are rising, supply chains are restricted, and ports are overcrowded. Some believe that — considering all of these factors — policy makers stopped providing stimulus too soon.

However, expert opinion is anything if set in stone, and different researchers have differing opinions and explanations. Other experts believe that a recession is a possibility, but they don’t believe that the positive indicators should be overlooked or ignored. Even though many Wall Street banks aren’t predicting strong economic growth, they’re still seeing expansion. For example, Goldman Sachs projects 5.6% growth this year. And even though the number is not as high as once predicted, it still indicates positive growth for the United States’ economy.

Truth be told, no one could have predicted how COVID affected the economy. Researchers are only now seeing the true effects and — even though they’re trying their best to record and compile the data — it’s hard to make accurate predictions in such a short period of time. However, there are certainly risk factors and warning signs that need to be addressed. If ignored, the experts predicting a severe economic downturn could be proven right.